As a buyer’s agent, I frequently encounter clients who are disheartened by the property buying process, especially in the current climate. A recent article has highlighted a growing issue in the real estate market—certain tactics used by selling agents that, while questionable, are becoming increasingly common.

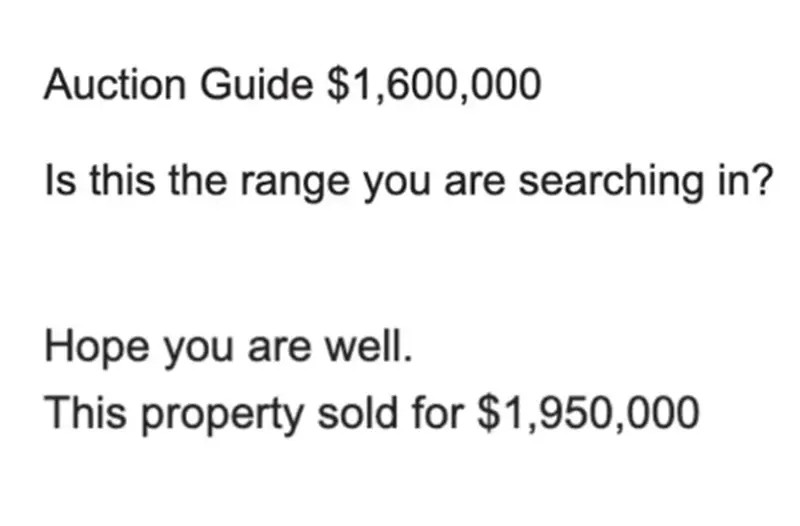

The Key Issue: Manipulative Practices One of the most frustrating aspects for buyers today is dealing with underquoting and price manipulation. This practice, where a property is advertised at a lower price to attract more interest, only to sell for significantly more, is not just misleading—it’s downright discouraging for genuine buyers. Clients often feel misled, wasting time and resources chasing properties they simply can’t afford.

The Emotional Rollercoaster For many, buying a home is one of the most significant decisions they’ll ever make. When faced with constant underquoting, potential buyers are often left feeling defeated. They may spend weeks, even months, attending auctions and inspections, only to find that the property sells well above the quoted range. This process not only drains their finances but also their enthusiasm.

Why Buyers Are Turning to Agents Given these challenges, more buyers are turning to professional buyer’s agents to help navigate this tricky terrain. We work to ensure that our clients are well-informed, have realistic expectations, and are not misled by inflated quotes. By providing access to accurate market data and helping to manage expectations, we can guide buyers towards properties that truly match their budget and needs.

A Call for Transparency It’s time for the real estate industry to embrace greater transparency. Buyers deserve accurate information that reflects the true market value of properties. Until then, the frustration will continue, and many will feel alienated from what should be an exciting journey to homeownership.

By addressing these frustrations head-on and offering solutions, this perspective emphasizes the value of a buyer’s agent in helping clients navigate the challenges of the current property market.