Originally slated for a January 2026 start, the Albanese government has brought forward its expanded First Home Guarantee (FHG), which allows first-home buyers to purchase with a low deposit by three months, launching the scheme on 1 October 2025.

What’s Changing?

Low Deposit Access

If you’re eligible, you can now buy with a 5% deposit, with the government guaranteeing up to 15% of your loan helping you avoid costly Lender’s Mortgage Insurance (LMI)

Removal of Income Caps

The previous income thresholds of $125,000 for singles and $200,000 for couples have been scrapped. Now virtually any first-home buyer meets the income eligibility

Uncapped Scheme Places

Unlike prior limits such as 35,000 annual spots, the scheme now has no cap on the number of participants

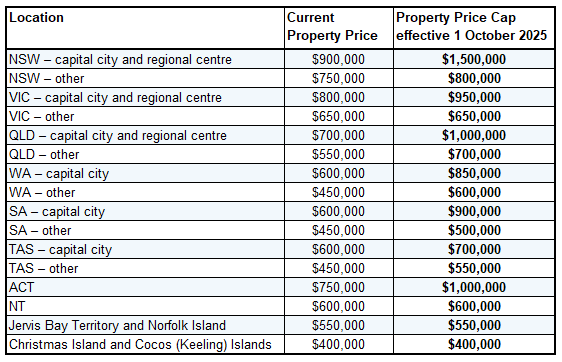

Higher Property Price Caps

The maximum property values under which you can apply have increased significantly. Examples include:

Sydney: from lower thresholds to $1.5 million

Melbourne: $950,000

Brisbane & Canberra: $1 million

Adelaide: $900,000

Perth: $850,000

Regional areas: between $400,000 and $800,000

These align with pre-announced Budget caps intended for January 2026

Potential Impacts on the Housing Market

Boost in Access, but at What Cost?

Affordability Gains: For first-time buyers, especially younger earners, this creates a newfound opportunity to enter the market even with limited savings. It could save thousands in LMI and years of deposit savings

Market Demand Surge: Analysts warn that the policy could inflate home prices, particularly in the first-home buyer segment. Lateral Economics projects a 3.5% to 6.6% rise nationally within a year, potentially peaking at 9.9%

Treasury vs. Insurance Council Outlooks:

Treasury’s optimistic estimate: only 0.5% price increase over six years

Insurers and economists: significantly higher short‑term spikes

Wider Criticism:

Some argue the expanded scheme may primarily benefit those already capable of purchasing, potentially crowding out more vulnerable buyers

Others argue that it’s distracting from the root problem, which is supply shortages, and increasing the risk of a greater housing bubble.

Supply-Side Measures: The government defends the policy by citing parallel actions pausing parts of the National Construction Code, fast-tracking approvals for 26,000 homes, and aiming for 1.2 million new homes by 2029 but critics remain cautious

Our Final Thoughts

The government’s decision to bring the expanded First Home Buyer Scheme forward to 1 October 2025 marks a bold attempt to address housing affordability by offering low-deposit, broadly accessible pathways to homeownership.

For many, especially younger or lower-wealth individuals, it presents a significant opportunity to enter the property market; however, it also raises concerns, particularly around price inflation, market overheating, and systemic supply constraints.

The success of this policy will hinge on striking a balance between demand stimulation and meaningful action to increase housing supply. Without that, it risks making homeownership less attainable rather than more affordable.